111 South King Street, Honolulu, Hawaii

111 South King Street, Honolulu, Hawaii

To fuel the success of local entrepreneurs and diversify Hawaii’s economy for generations to come.

We’re in this business since 1988 and provide the best services

Grow our economy &

provide more local jobs

Embrace what makes our community unique

Create a sustainable Hawaii for future generations

Supporting local has never been more meaningful than it is today. Bank of Hawaii and Mana Up, a local accelerator program, are joining forces in a celebration of local makers and artisans.

Call Anytime

+ 1 (307) 776-0608Getting a HELOC can help you achieve your dreams, from education to home renovation. To get the most out of your HELOC, follow these steps.

You'll want to shop around to find the best deal. Some lenders may offer a low introductory rate for the first 12 to 60 months of a HELOC, making it tempting to jump into a bargain, but make sure you take into account the rate that will be applied after that promotional period, since it will be higher and most likely variable, meaning your monthly payments could increase significantly over the life of the loan.

When applying for a HELOC, it's smart to plan, and then plan some more. For starters, you should think carefully about how much you really need to borrow. Just because you may be able to tap into, for example, $400,000 of your home’s equity, it doesn't mean you should necessarily max out your credit capacity.

Once you've secured your HELOC, remember to use the funds on projects that will build value, such as home renovations. HELOCs aren't intended to help you live above your means and shouldn't be spent on anything risky. Think carefully about using your HELOC on depreciating assets such as vehicles, vacations or luxury goods, and avoid speculative gambles such as investing money in the stock market.

Business, Finance

Most marketing budgets today don’t allow businesses to pursue every distribution channel at once. You need to carefully select channels that are most likely to bring strong returns from your investment.

Business, Finance

86% of social marketers already use Facebook ads, and the platform’s advertising revenue continues to grow. Meanwhile paid advertising options have come up on Instagram or elsewhere.

Business, Finance

Most marketers today understand they need to produce large volumes of content to build a traffic base. They often focus on creating new content, overlooking the value in their existing assets.

Business, Finance

People look for recommendations from their peers to make purchase decisions. Your own customers are a powerful resource to help you reach new audiences and drive conversions.

Business, Finance

Creating a message that speaks to your target audience is only the first step to success in online marketing. It doesn’t matter how great your content is.

Business, Finance

Creating a consistent customer experience online and off is an important aspect of memorable marketing in 2021. More and more businesses are using virtual and in-person events to influence audiences and drive sales.

Business, Finance

This one is one of our most important marketing tips. Consumers today are well aware that the content businesses create is agenda-driven. They’re not likely to respond positively to salesy content.

Business, Finance

There are only so many ways to directly promote your products and services through marketing. Sometimes it’s worthwhile to stray away.

Business, Finance

Advertising is a great way to broaden your reach on social media and the web. But it doesn’t compare to the power of a strong recommendation from knowledgeable influencers.

Business, Finance

Any seasoned marketer knows the importance of performance analytics to optimize their strategy. But waiting until the end of a marketing campaign to analyze and adjust.

Business, Finance

Having a strong marketing strategy requires more than adjusting your priorities year after year. You have to be constantly on the lookout for technologies and opportunities.

Business, Finance

Treat your unhappy customers well and treat your happy customers like your best friend. When customers are unhappy, you need to put in effort to resolve the issue and brighten their day.

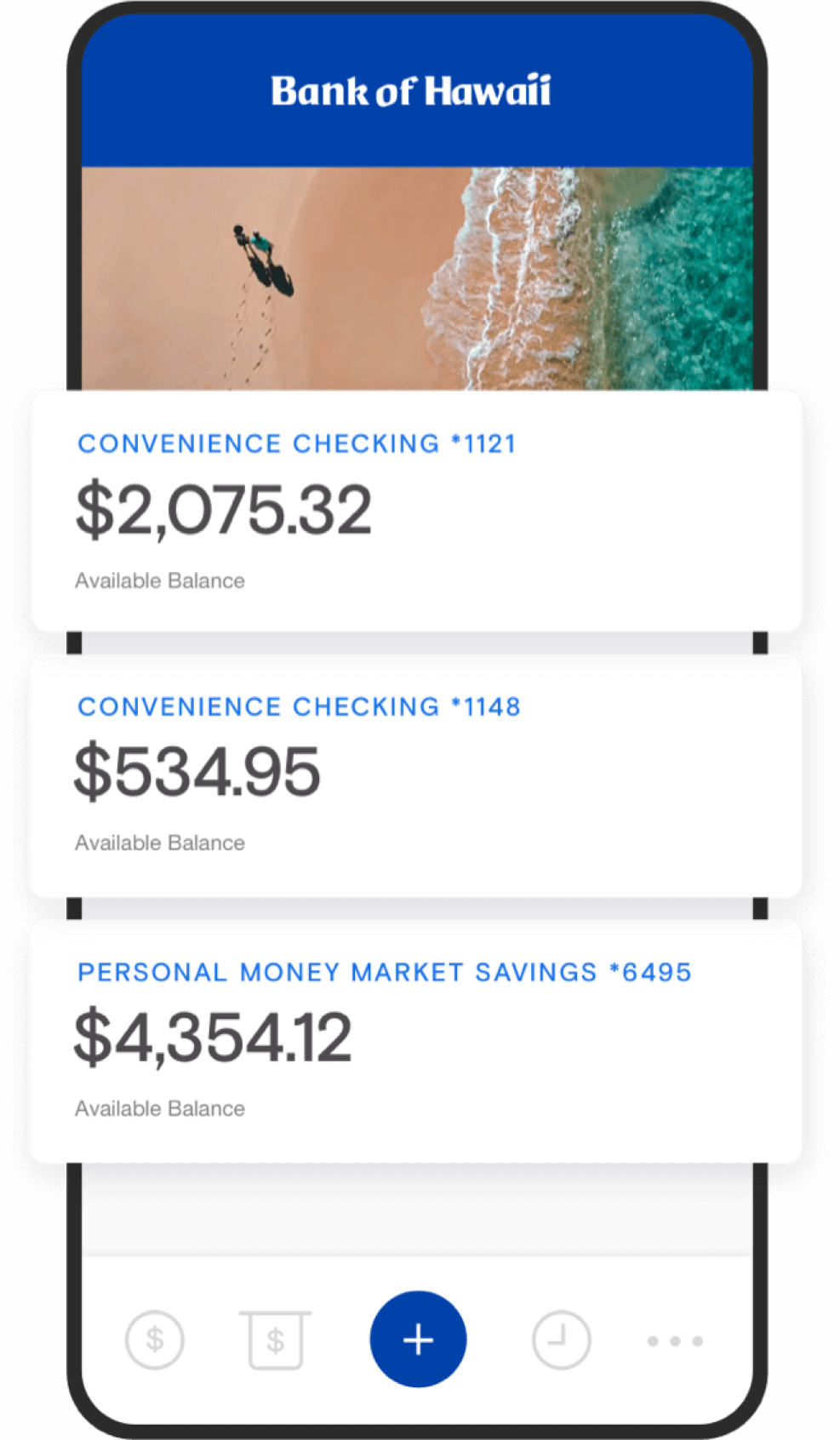

Commercial/Corporate Banking Clients - “Bank of Hawaii products and services have been instrumental during the pandemic.”

The Private Bank Clients - “The synergy between my family and Bank of Hawaii is an integral part of my success as a young professional.”

Branch Banking Clients - “2020 has been a tricky year for Peterson Bros. We’ve had to make changes to adapt with the changing times.”

Transactions Per Day

Satisfied Customers

Expert Consultant